Quicken Loans Nexsys Clear path

In 2015, the government added the TILA RESPA Integrated Disclosure (TRID) regulation to the mortgage industry. This regulation dictated that mortgage companies must provide a Closing Disclosure that includes all fees to the client a minimum of 3 days prior to closing on a loan.

In response to this regulation, Quicken Loans created a portal for Title/Settlement Agents to communicate with QL and prepare the Closing Disclosure in a timely and accurate manner.

My Role

I was the sole UX designer on this project, responsible for the experience and design of the website. I also did field research with closing agents to gather user insights used to create journey maps. I worked very closely with the Product Manager and alongside a UX Specialist who conducted user tests of the UI.

The Problem

Getting Title/Settlement Agents to adopt a new system of communication.

Facilitate the communication of fees during the closing process.

Provide a way for Title/Settlement Agents to upload/download closing documentation

One of the biggest challenges was getting agents to use an additional system in their workflow to reconcile the fees used to create the Closing Disclosure document. There were plenty of technical constraints due to back end system integrations and the business requirements from stakeholders were very specific so I had to continuously advocate for the end user. Through field research, user testing and a lot of communication with stakeholders the portal evolved into a user centered system that Title and Settlement Agents successfully adopted.

User Research

I visited multiple title companies and interviewed associates to get a better understanding of the closing process and their relationship with QL. Our goal was to gather feedback that could be used to influence strategy and improvements for the Quicken Loans Nexsys Clear Path agent portal.

Title Agent Journey Map

Fees 1.0

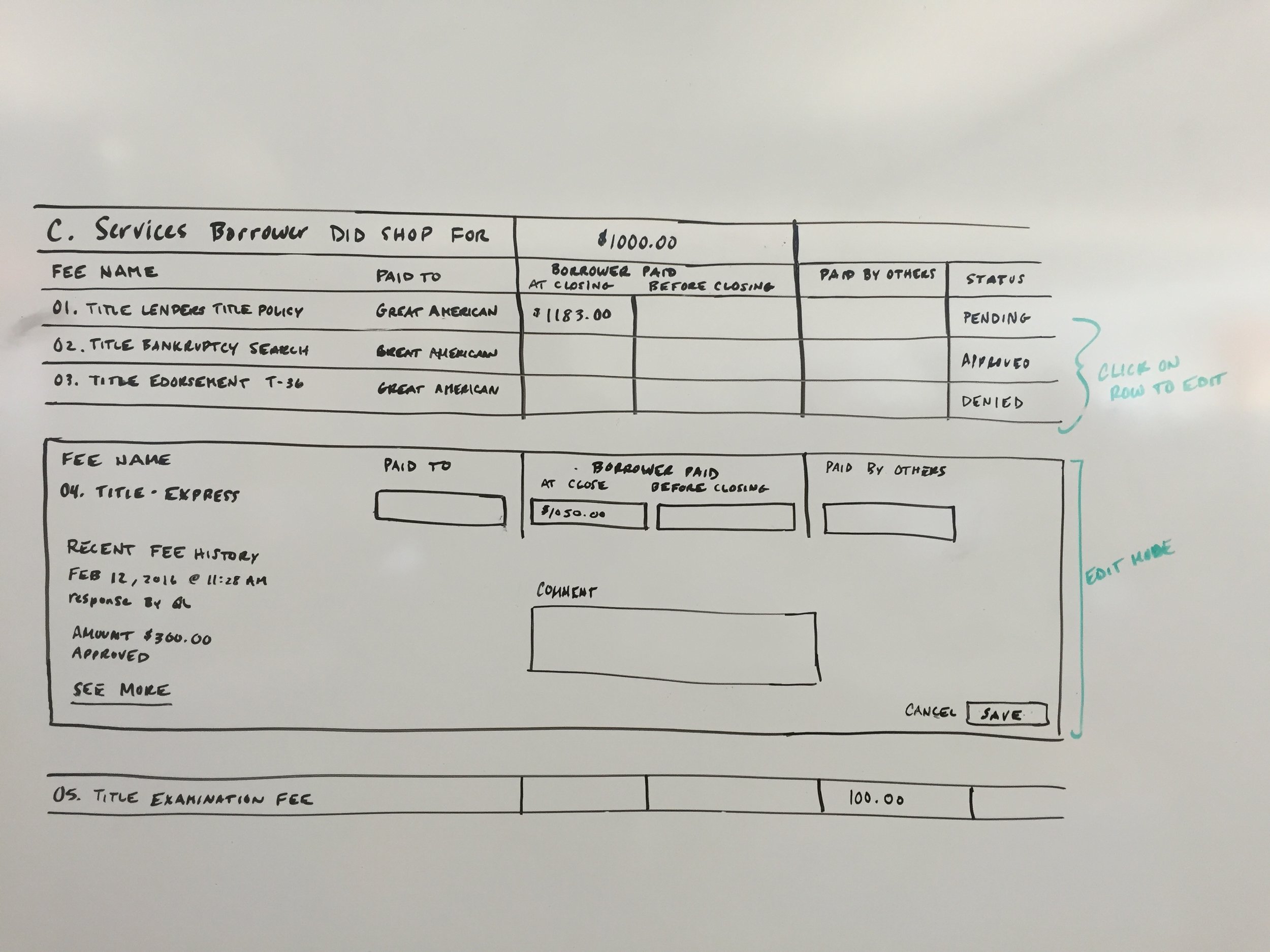

As mentioned above, one of the most important areas of the portal was the fees page. Title Agents are expected to enter their fees and communicate with Quicken Loan Closing Specialists in order to balance the Closing Disclosure document.

Fees 2.0

After the product met the initial launch deadline, we were able to use client feedback to drive a revamp of the fees page. One issue we identified early on through user testing was that agents expected the interface to be similar to the actual document it was used to generate. By using the alphanumeric system of the Closing Disclosure and adding additional sections we were able to improve the user experience. This redesign also allowed the feature set to expand.